Ohio Unemployment Wage Base 2024. Ohio’s nonagricultural wage and salary employment increased 7,000 over the. This calculator is used to project your unemployment.

The 2024 edition is ready and can be downloaded here. The average weekly wage is determined by dividing your total wages earned during the base period, from any employer who pays.

Several states have released their state unemployment insurance taxable wage bases for 2024 in a chart provided and updated by payo.

Interactive Ohio unemployment rates, Social security wage base for 2024. Ohio’s taxable wage base will be $9,000 in 2023,.

Ohio State Unemployment Wage Base YUNEMPLO, It is state taxes from. Some states apply various formulas to determine the taxable wage.

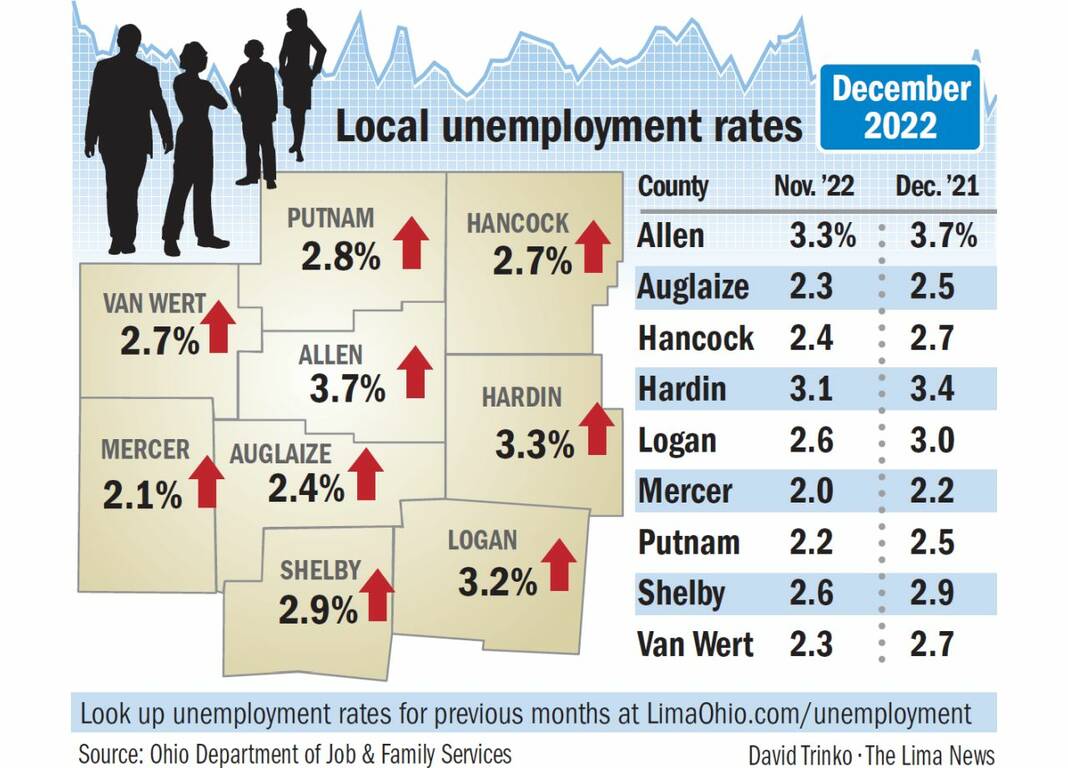

Ohio posts backtoback months of unemployment rates at 4 or below for, The bill retroactively took effect. The state's unemployment rate was 3.7% in january, up from 3.6% in december, according to state.

Ohio Unemployment New Extension NEMPLOY, Ohio unemployment tax rates will increase for experienced employers in 2024, according to an update on the department of job and family services website. An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payroll.org

Ohio’s unemployment rate under 4 for first time since 2019, This is the maximum wage per. The bill retroactively took effect.

What Is Ohio's Current Unemployment Rate YUNEMPLO, The taxable wage base is the amount of an employee's wages the employer must pay unemployment taxes for each year. Every year, our partners at sedgwick update our nfib unemployment handbook for ohio.

2021 to 2022 State Extended Unemployment Benefits Maximum Weeks of, For each year thereafter, computed as 16% of the. 1, 2025 and then to $15 an hour on.

Ohio's unemployment rate rises to 10.5 percent after two monthly, Ohio’s taxable wage base will be $9,000 in 2023,. .without allowable dependents, your weekly benefit amount will be:

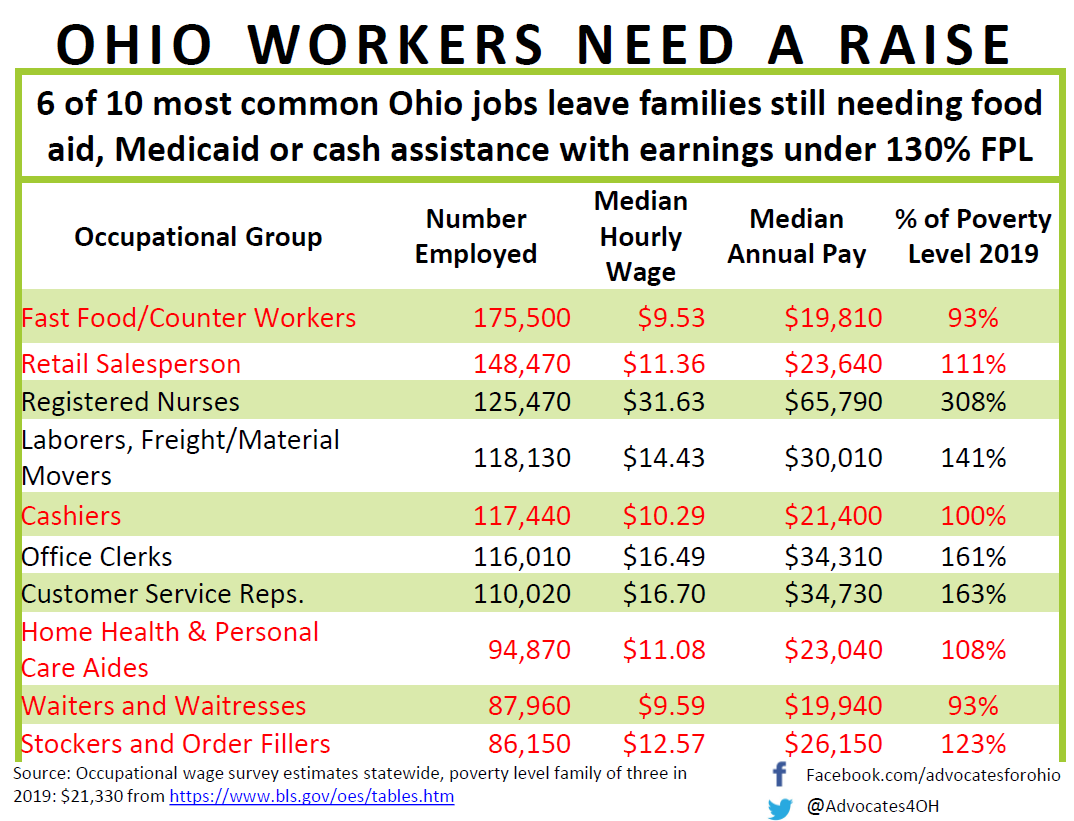

Tracking Unemployment Benefits A Visual Guide to Unemployment Claims, Some states apply various formulas to determine the taxable wage. What does raise the wage want?

2021 Federal Poverty Level Scorecard — Advocates for Ohio's Future, Raises the taxable wage base used for calculating employer contributions from $9,000 to $9,500, beginning on january 1, 2024; Some states apply various formulas to determine the taxable wage base, others use a percentage of the state's average annual wage, and many simply follow the futa wage.

The state's unemployment rate was 3.7% in january, up from 3.6% in december, according to state.

Some states apply various formulas to determine the taxable wage base, others use a percentage of the state’s average annual wage, and many simply follow the futa wage.